Justice Finance – Helping the Individuals Behind the Cases Find Their Voice

If access to justice is a right, why does it still feel like a privilege? Edenreach, the new female-founded justice fintech, believes the problem isn’t just financial, it’s systemic. And they’re designing ways to resolve it. They’re building the pathway to move billions in ethical capital to the very people and cases that need it most.

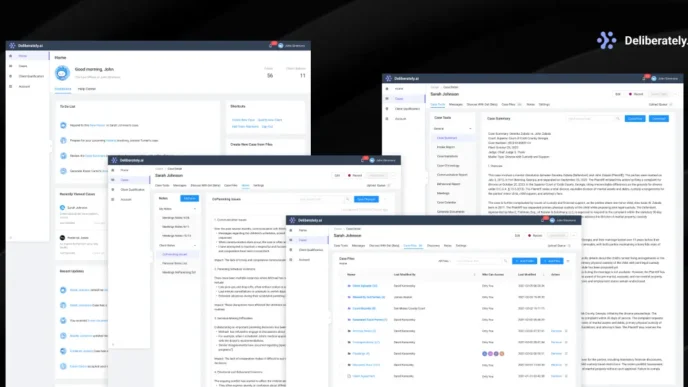

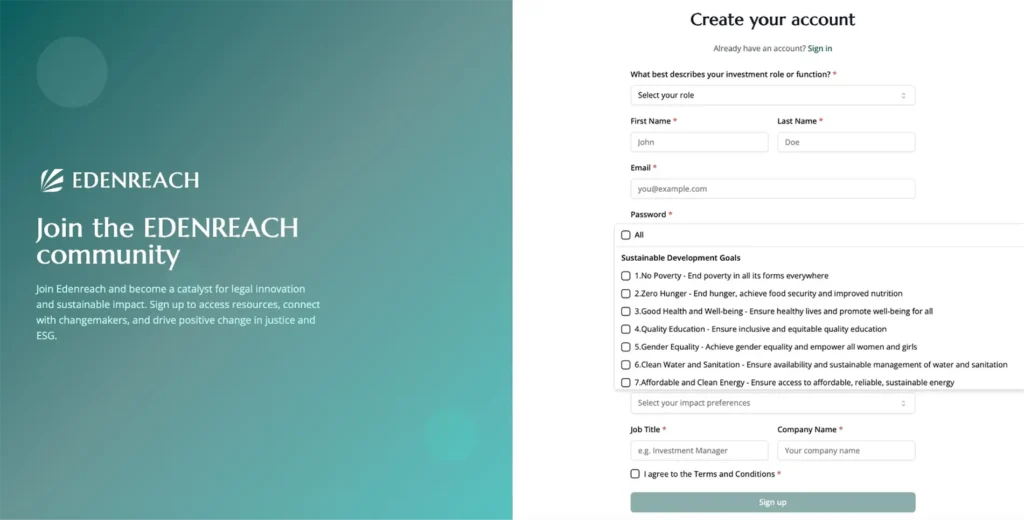

Co-founders Kayee Cheung and Melina Gisler are steering Edenreach with precision and purpose. Alongside the company’s advisory services, their core product offering is an AI-supported case evaluation platform that maps legal claims against their proprietary Justice Finance framework, which uses United Nations’ 17 Sustainable Development Goals (SDGs) as a spine. This provides a certification for the cases and produces Environmental, Societal & Governance (ESG)-aligned impact reports. In doing so, it positions litigation financing not as an opaque, risky bet, but as a new category of investable impact asset with measurable social returns and competitive financial returns.

Bridging a Capital Disconnect

Litigation funding is not new, but Edenreach is asking why it hasn’t gone further. Why hasn’t more of the $3.3 trillion ethical capital market (GIIN 2024, NPT 2024) found its way into the justice system?

With this in mind, we asked Edenreach how they came to see justice finance as a capital allocation problem rather than just a legal infrastructure one?

“Every day, people face any number of obstacles to accessing justice and funding is one of the biggest barriers,” says Melina Gisler, Edenreach co-founder and product development lead. “Without mission aligned financing, important cases aren’t being pursued, meaning fewer positive social and environmental causes getting the attention, and outcomes we need. Traditional litigation financing often overlooks these critical areas in the pursuit of profit, but we knew that we could connect with impact-driven investors who were looking for new avenues to create positive, meaningful change and returns. Legal infrastructure is essential here, but without ethical and financial infrastructure it can’t scale. This is how we came up with the idea behind Edenreach – turning legal cases with the potential for positive ESG outcomes into investible assets.”

“When you look at the justice gap through the lens of capital markets, you start to see that the real bottleneck isn’t necessarily legal infrastructure, it’s trust – the certification and reporting required for allocation,” says Edenreach co-founder Kayee Cheung, the brains behind the company’s financial model. “There’s already trillions in mission-aligned capital waiting to be allocated in donor-advised funds, philanthropic investment portfolios, and private foundations, not to mention impact investment funds. Capital pools exist. Case pipelines and legal structures exist. What’s missing is the infrastructure to channel the capital towards impactful justice outcomes. Edenreach exists to build that bridge.”

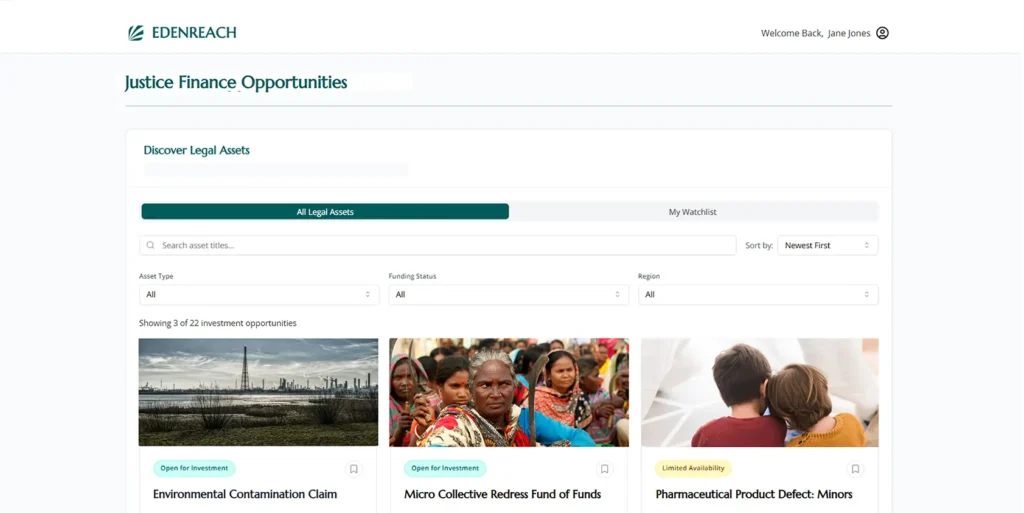

Edenreach’s response is to reframe the issue entirely using a 3 pillar approach: Tech enablement, storytelling and capital innovation. An example of capital innovation is reframing Justice Finance to extend to micro case segments. Through a fund-of-funds strategy and innovative bond-like investment instruments, the platform can unlock funding for housing disrepair, consumer protection, and debt claims, which are the cases that are typically too small for traditional funders, alongside class actions and other aligned cases.

These issues are not niche. They’re everyday problems with enormous cumulative impact and returns.

Technology, Meet Trust

The platform soft launched at the start of October 2025 and introduces two major components: a case assessment engine and standardized ESG impact reporting. The former analyses and certifies cases against the 17 SDGs, surfacing cases aligned to impact goals. The latter makes sure investors can see the ongoing social and financial return on their contributions.

Many funders are skeptical of ESG in legal finance. What we wanted to know from Kayee and Melina, is how they’re ensuring the credibility and standardization of the impact metrics that Edenreach provides.

Kayee explained that “just as legal professionals require due diligence, compliance and security to build credibility and standardisation, justice finance needs a universal impact language to foster trust and consistency. Our approach uses the framework of the UN’s SDGs as a spine, to ensure transparency and attribution are built into the process from the start. This means investors can see where their capital went and what societal return it generated.”

This isn’t just about financial flows. Kayee and Melina are rebuilding trust in litigation finance through transparency, traceability, and a framework investors can understand. Edenreach’s assurance model aims to meet that need, offering compliance tools and smart tech that allow ethical capital to enter the legal space without friction.

Systems Thinking at the Core

Both Kayee and Melina come from backgrounds that have forced them to question old models. Kayee has built commercial teams in some of the world’s leading consumer tech platforms, while Melina has spent years turning real world problems, and now legal pain points, into product blueprints. Edenreach is what happens when those two mindsets unite.

Given their diverse experiences, we asked Kayee and Melina about the lessons they’ve taken from building in other industries that they’re now applying to justice finance.

“My approach to innovation is probably best described as ‘cross sector systems transfer’; identifying models from other industries which can be applied to a specific problem. I’m less interested in reinventing the wheel and far more excited by the prospect that the best solution might be discovered simply by looking at a problem in a new light. Coming from platform and product-led industries, I’ve seen how trust and usability determine adoption. Legal finance has historically been opaque, so we’ve taken lessons from consumer tech and fintech to make participation simple, compliant, and confidence-building,” said Kayee.

While Melina’s method is influenced by a background in law and an insight-led approach to solution building. “For Edenreach, validating our hypothesis was absolutely critical to our product development journey. We wanted to understand the problem and test the appetite for what we were creating. Over the last year, we conducted research into the role that smart tech can play in bridging the access to justice gap and validated our thinking with experts from the legal and finance worlds. The insights gleaned during that process have helped shape the platform we’re now bringing to market.”

Their product decisions reflect that interdisciplinary approach. The inclusion of alternative dispute resolution pathways, for instance, acknowledges that not all legal outcomes require a courtroom, and some just need resolution. Their commitment to storytelling and brand design also points to an overlooked truth in legal finance: perception matters. If capital can see itself in the story, it’s more likely to fund the ending.

Making Legal Impact Legible

By using the SDGs as a common language, Edenreach helps impact investors understand what a legal case actually does. Does it advance housing rights? Protect consumers? Improve labor conditions? The platform surfaces that relevance. And with their proprietary impact reports, it gives investors something they can show to their boards.

In the legal tech and AI space, the SDGs have attracted increasing attention. We asked Kayee and Melina how they came to view the SDGs as the right framework and whether there were other models they considered before committing to that lens.

Kayee says: “We needed a universal framework that investors and citizens could both understand. Ethical investors require robust reporting and measurement that can easily integrate into their existing systems. Being able to demonstrate outcome, rather than just output, is a fundamental part of accountability. Impact also needs to resonate at a human level, so everyone can understand what has changed or been achieved as a result of an action.”

She continued that “When we considered this, we realised we needed a framework that would underpin the universal justice finance language needed to build trust and consistency. The SDGs are designed for global comprehension and industry application. They are globally accepted as a shared blueprint for social and environmental impact, making them the perfect anchor point as we build a bridge between two previously unconnected structures.”

This clarity is essential, especially as the litigation funding market faces growing scrutiny. As reported by the Financial Times, recent UK restrictions on funder returns have chilled appetite for class actions, even as unmet legal need continues to grow. Edenreach is carving out a new lane that aims to combat some of those regulatory tensions by meeting the higher ethical compliance requirements to widen the pool of investors and narrow the investment horizon.

A Scalable Vision for a Fragmented Market

In a sector where funding often flows to the biggest claims, Edenreach is also focusing on the ones that fall through the cracks. Their model emphasizes not only economic return but social salience, and they’re betting that’s what will bring in new capital.

Looking to the future, we asked Kayee and Melina to explain the role they see for partnerships in scaling this model globally, particularly in jurisdictions outside the UK.

“Justice Finance is inherently global; the problems it addresses don’t stop at borders,” says Kayee. “We want to build a worldwide mission-aligned, justice finance community to amplify our work and bring scale to what we’re trying to achieve. We’re creating a blueprint that can be localized. The principles — ethical capital, structured access, measurable impact — stay constant, but the pathways adapt to each jurisdiction.”

Melina adds that “Scaling justice finance requires collaboration between funders, technologists, regulators and local practitioners. We’re already working with think tanks like BIICL to ground our approach in rigorous research, and partnering with institutions like the Law Society, LawTechUK, the Innovative Finance Initiative, Justice Tech Association in the U.S. and Canada’s Legal Innovation Zone to amplify our reach and pressure-test our models.”

Their roadmap, which includes continued investment in smart technology, deeper collaboration with legal institutions, and further work with think tanks aligns with their ultimate goal: To make justice finance both investable and intelligible, not just for funders and lawyers, but for the communities it serves.

Justice, Reframed

Edenreach doesn’t treat access to justice as a charity aim. They treat it as a capital problem with a product solution that has charitable purpose. And they’re asking investors to rethink their role not just as funders, but as stakeholders in systemic resolution.

As more cases are assessed, more metrics reported, and more capital deployed, the questions will shift from “Is this possible?” to “How far can it go?”

For more information about Edenreach, to discuss submitting a case for assessment or funding, please visit www.edenreach.com or contact the team via email at info@edenreach.com.