The LP transfer process has long been the paperwork-stuffed junk drawer of fund operations: essential, ignored, and increasingly messy. Ask any fund lawyer or admin professional and they’ll tell you the same thing: the legal work isn’t the problem, it’s everything around it. Emails fly around. Spreadsheets multiply. Signatures hide in plain sight. Now imagine all of that, but…cleaned up. That’s what Navys is building.

Founded by Amr Jomaa, a former funds lawyer at Kirkland & Ellis and Cleary Gottlieb, Navys is a legal technology player that’s rethinking the operating system for funds, starting with a notoriously painful workflow: LP transfers. The platform centralizes every step of the transfer from initial outreach to final closing, into one structured, secure workspace. It’s not a flashy add-on or a chatbot bolted onto legal work. Navys offers real infrastructure.

This week, The Legal Wire sat down with Navys’ founder Amr, to understand how the platform emerged from the trenches of fund formation work and what it might signal about where legal tech is headed next.

TLW: Amr, what did you observe during your time in practice that made you feel LP transfers were the right entry point for a broader fund-focused legal OS? Why tackle this workflow first?

Amr: “When I was practicing, I watched brilliant lawyers spend hours on work that should have been done by software: chasing signatures, reconciling spreadsheets, answering the same status questions. LP transfers captured this dysfunction perfectly: over 100 emails and 90 days per deal on average, almost entirely administrative overhead. There is no reason transfers should be painful. The fact that they are, for everyone involved, points to a failure of infrastructure, not complexity. The secondaries market has grown fast; the execution layer has not. That gap is where we started, because transfers touch every party in fund operations. Build infrastructure that works there, and you have something that scales across the entire fund lifecycle.”

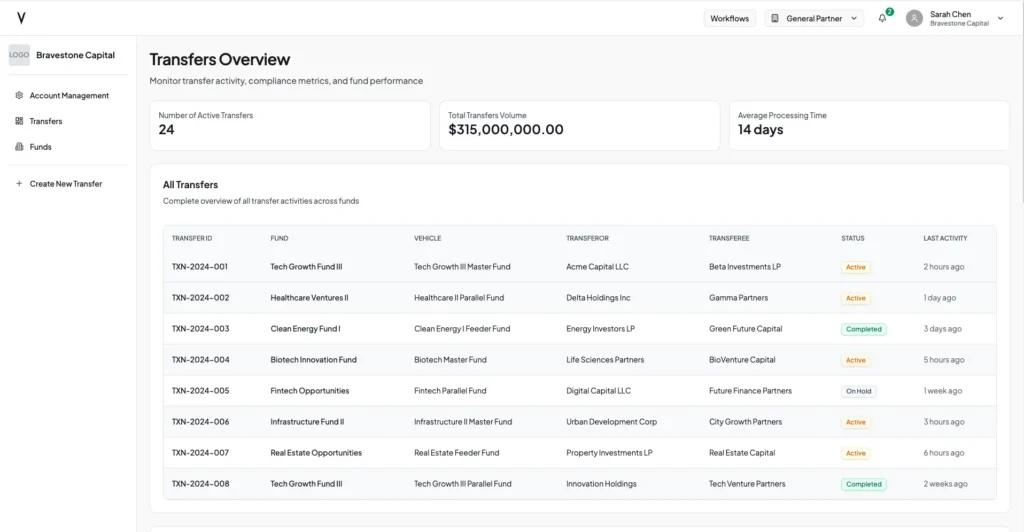

The result is an interface that mirrors real-world workflows. GPs, LPs, law firms, and fund admins all work from the same live dashboard, tracking every status update, bottleneck, and sign-off in real time. There’s no need to chase counsel for an update or dig through your inbox for the latest redline. The platform replaces static trackers and fragmented communication with a fluid, collaborative process.

And it’s working. According to Navys, transfers executed through the platform are closing 80% faster, withover 100 emails saved and$10K in average cost savings per transaction. In a field where margins are tight and timelines tightrope against investor expectations, those metrics are operational leverage.

TLW: Navys has clear value props across stakeholders — GPs, lawyers, LPs, admins. But internally, what’s the north star for product development? How do you make decisions about what gets built next?

Amr: “Before building any feature, we ask one question: does this make life materially better for the funds practitioners who will use it? Not abstractly, not eventually, but in the concrete reality of their working day. That is the only test. If a feature does not reduce burden, clarify process, or eliminate work that should never have been manual, we do not build it. The bar is usefulness, not novelty.”

Navys is also aiming to solve the problem of institutional memory. Every action on the platform is traceable. Document review? Tracked. Signatures? Audited. Approvals? Time-stamped. Even junior lawyers or paralegals can now run transfers end-to-end without tripping over version control or endless coordination loops.

There’s also support built in: live chat with 24/7 coverage, and an AI-powered transfers coach designed to help new users navigate the platform and get real-time guidance.

Security, of course, is foundational. The platform is ISO 27001:2022 certified, GDPR and SOC I/II compliant, and built on Azure Active Directory with native SharePoint integration. In short: it ticks the boxes that compliance teams lose sleep over.

TLW: There’s been a lot of 2026 predictions about legal tech moving toward niche, purpose-built tools rather than generalist platforms. How did you decide where Navys falls on that spectrum, and how do you see the legal tech market evolving this year?

Amr: “I think the best legal tech tools emerge from practitioners who intimately understand a specific domain and can translate that expertise into foundational legal infrastructure. For Navys, that’s investment funds. We’re building the system that will hold the legal and operational reality of private capital markets, taking into account the nuances and specific complexities of this sector.

In 2026, I think we’ll see the market reward genuine sector expertise. The platforms that become essential will do more than solve operational problems. At the end of the day, this is not about software. A fund manager who makes their investors’ lives easier is a fund manager investors want to back again. A law firm that delivers seamless execution is the law firm clients return to. That is our real value proposition: not software, but competitive advantage.”

Looking ahead, Navys isn’t content to stop at transfers. The vision is broader: to build the legal OS for funds, one concrete workflow at a time. The goal is execution, not just abstraction. And that’s what makes Navys worth watching. It’s built by someone who’s had to do the work, for the people doing it.